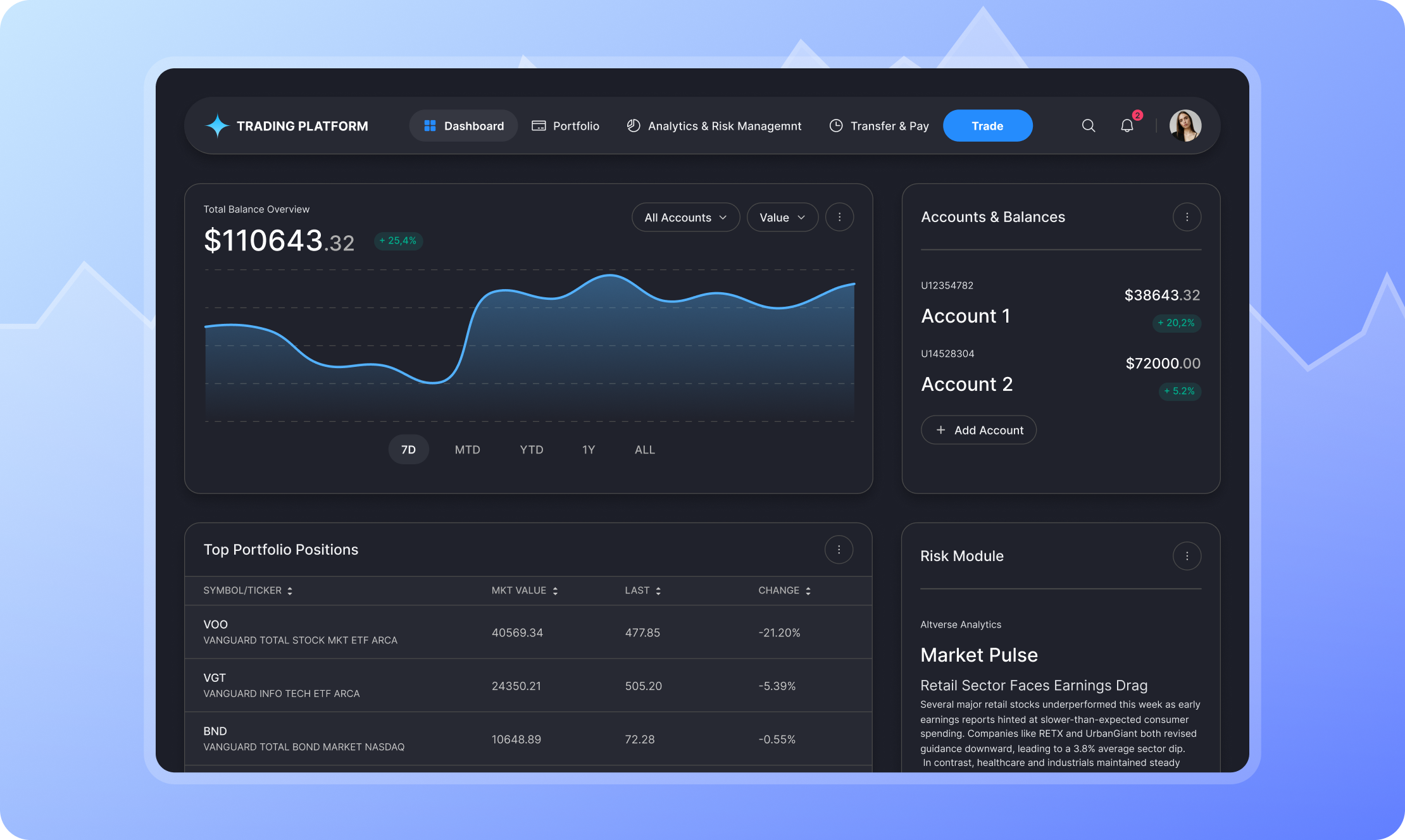

An advanced cloud platform for commodity trading and risk management

A top cloud-based platform designed to simplify commodity trading by enhancing risk assessment, streamlining trade management, and empowering traders to track market fluctuations, optimize decisions, and execute trades with precision and speed.

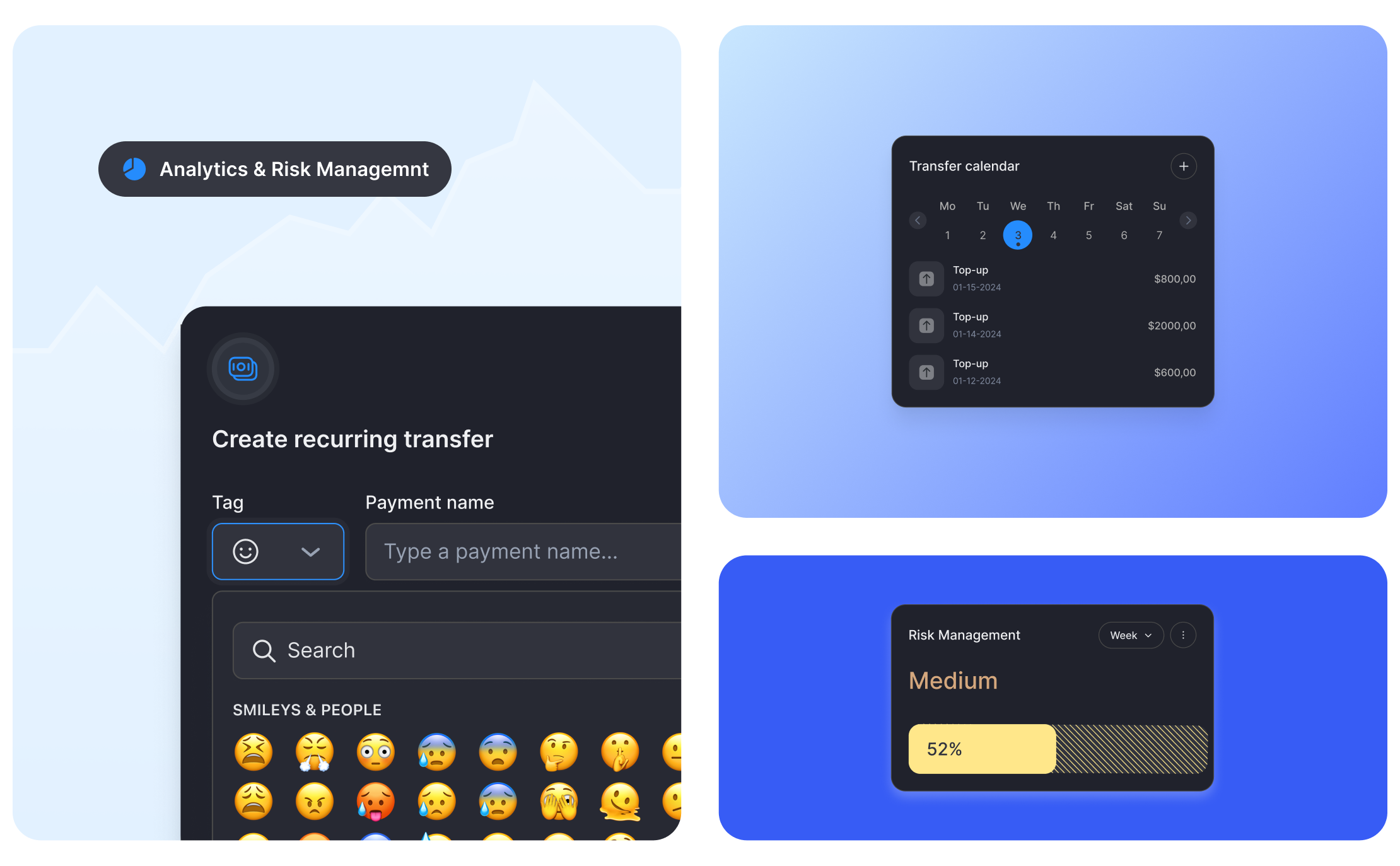

This platform features three core modules:

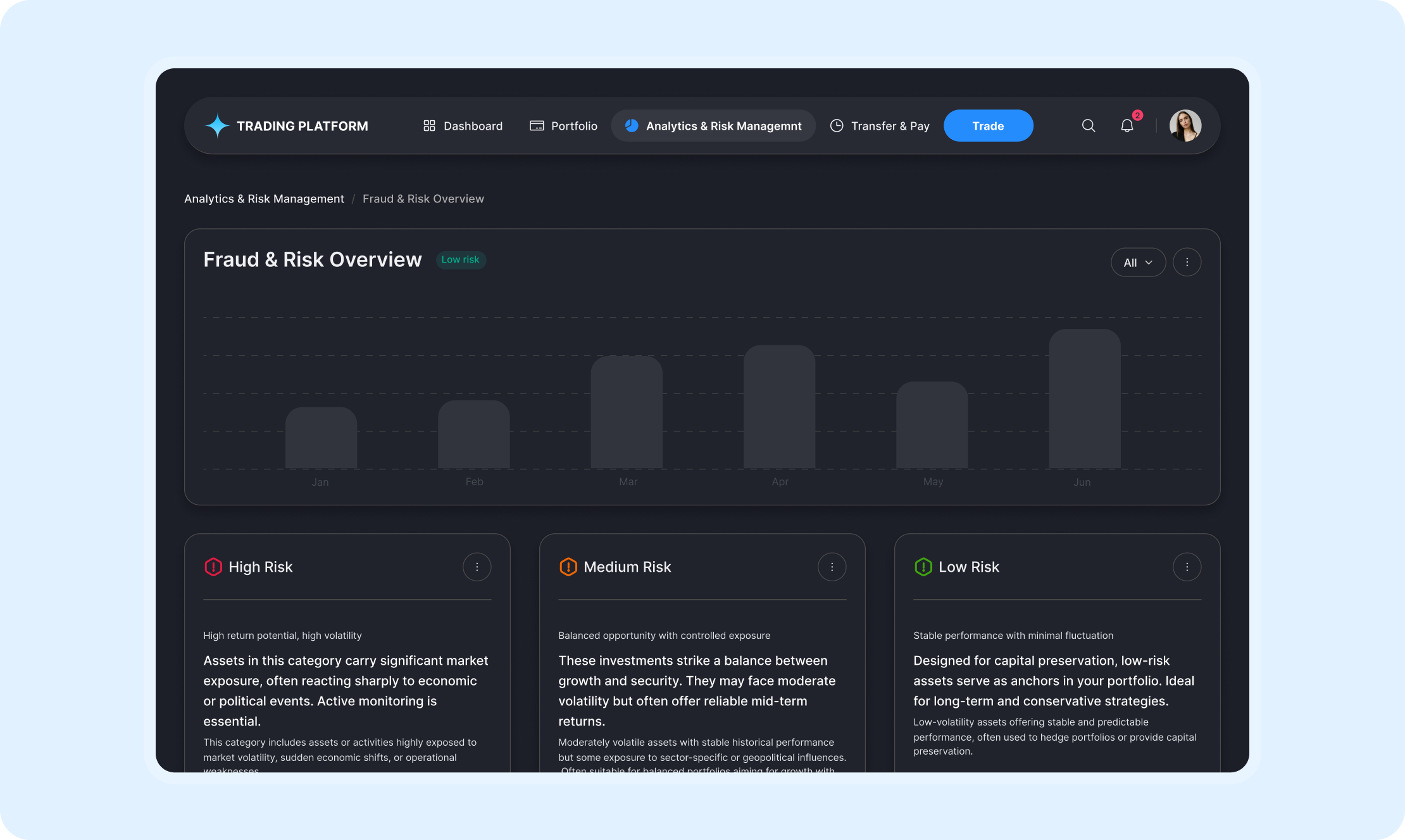

•Risk Module: Helps manage risks effectively.

•Blotter Modul: Provides a detailed trade history and reporting with advanced filters.

•Whiteboard Module: Offers tools for systematic strategy management.

Designed as a multi-tenant application, the solution ensures seamless risk management, trade execution, and analysis — all within a single, unified system.

This was a specialized trading platform development project that started with a full-stack developer, focusing on core functionalities such as:

- Risk analysis

- Profit & Loss (P&L) calculations

- Trade tracking

Through regular sync-ups with the client, Honeycomb Software ensured effective communication and alignment on project goals. As the project expanded, the team grew, and new features were introduced:

- Value at risk (VaR) – assesses potential trading risks over a specific timeframe.

- Integrated risk management (IRM) – a comprehensive approach that provides real-time risk assessments.

- Bilateral trade facilitates trading between multiple parties.

- Live trading whiteboards display live prices, positions, quantities, and risks.

- Enhanced P&L calculations process that improves financial performance tracking.

- Market data integration allows seamless data access for traders.

Due to the complexity of the platform and the domain itself, having a dedicated QA specialist on a trading platform was a major advantage. The dedicated quality assurance expert focused on domain-specific testing, as trading platforms are highly specialized and require extensive knowledge to verify data accuracy.

Thus, they performed a complex scenario test where they simulated large datasets to mimic real-world conditions, ensuring the system could handle vast amounts of aggregated data. In addition, since data is sourced from multiple providers, the QA specialist rigorously tested:

- Graphs and charts for accurate data representation.

- Tables and formulas to ensure correct calculations.

- Real-time updates and synchronization across all modules.

Through collaboration with Honeycomb Software, the client modernized and expanded their trading platform, enhancing risk management tools, real-time market data, and advanced features like Value at Risk (VaR) calculations and bilateral trades. These improvements boosted efficiency, improved user experience, and secured additional funding for further growth.

Honeycomb Software’s QA engineer played a key role in this transformation by streamlining processes, reducing bugs, and enhancing system stability. Given the platform’s complexity, domain-specific QA was essential for verifying data accuracy in this specialized trading environment.

They are very good communicators and are very receptive. Right off the bat they understood what we were after and the solutions they provided where very competitively priced. The quality of their work is exceptional!

We’ll review your message and get back to you soon.

In the meantime, feel free to explore our case studies or submit another request.